Understanding Project ROI for Effective Reporting

READING TIME

6 minutes

QUICK SUMMARY

Learn to capture ROI qualitatively and quantitatively, understand tangible and intangible benefits, and improve information to support decisions.

This article is the third in a series looking at project reports in-depth. In the first article, we established that an effective report is a succinct, written, and episodic story to decision-makers about your project return on investment (ROI).

The second article gave tips on identifying and speaking to the report audience.

In this article, we look at ROI

what it means

why it’s so key to reporting, and

how to capture ROI qualitatively and quantitatively

What is Project ROI?

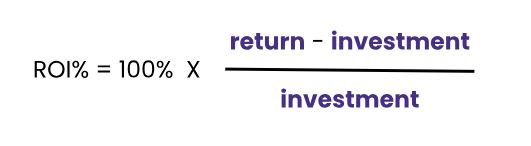

To calculate ROI, we need two numbers, return and investment:

Return is the sum total of tangible and intangible benefits that will result from the project.

The tangible return involves money - usually revenue or cost savings. For example, say your project is promoting a conference. It should result in an increase in registration fees.

Intangible benefits are the non-financial outcomes that increase value or success of stakeholders. Promoting a conference could strengthen the brand or lead to a better understanding of customers.

Investment is the sum total of tangible and intangible costs required to produce those results.

Again, the tangible part involves money changing hands: costs to design the campaign, to print collateral, and to run ads, for example.

Intangible costs are inherently harder to quantify, but can be just as (or more) important than tangible costs. Items such as the opportunity cost of time or strain on relationships can be part of the overall costs of a project.

As you can see, defining ROI is hard. Typically, it is impossible to come up with a precise number. So why bother?

Why ROI Matters for Reporting

The process of estimating ROI, both quantitatively and qualitatively,

defines project success

reveals important intangible benefits and costs

sets guardrails to guide decisions.

Project success is all about ROI - did the project return expected financial and non-financial benefits, and did those benefits exceed what the effort consumed?

A clear picture of expected returns for the level of investment is a building block of good reports. It’s a critical ingredient in determining progress, informing decisions and measuring success.

We may not be able to give a precise target for overall ROI, but we *can* articulate expected tangible and intangible results and costs.

As the project progresses, we tell that episodic story around ROI:

Is the project on track to deliver expected returns?

Are there changes that affect expected ROI?

What help do we need to meet the expected ROI?

If your project has some definitional documents - a business case, statement of work or charter, for example – many anticipated returns and costs can be found there.

If not, then you will have to do some sleuthing to derive the ROI on your own. Look for any sources that state expected outcomes and costs for the project. These can include emails, contracts, strategic plans, operational metrics and reports, presentations and meeting notes.

Determining Project Returns

We know that returns include both tangible and intangible benefits. Let’s look at another example to illustrate the returns portion of ROI.

Example: Remodel office space

Let’s say a company is remodeling its offices to improve functionality and aesthetics. In this case project benefits are largely intangible, such as improved morale and collaboration. It may improve productivity, but in a way that is hard to quantify.

Your report might include an Objectives section that states those assumptions: the remodeling effort is expected to enhance employees’ connection to the company, improve productivity and make their work more enjoyable.

Having that objective in front of the team, and in front of leaders, on a consistent basis helps to guide decisions. What if you complete the design and employees strongly object to some aspect? Since the project is intended to result in enhanced connection, it might be worth modifying the design even if that increases the cost.

Determining Project Costs

Tangible project costs are often the biggest portion of the investment, and easier to identify.

Office remodel example: Investment

If we look at the office remodeling example, much of the investment will be financial - design and construction, labor and materials.

The effort will probably involve some disruption to the environment, so these intangible costs should be stated as part of the investment, as this too will guide decisions.

Say the remodeling effort starts to incur big cost overruns. We would expect to include that information in our reporting. It would likely prompt corrective action.

It should be the same for intangibles. If disruptions match the expected level, then project communications can emphasize that the value of the project remains in line with costs. But if the level of dislocation far exceeds what was expected, then some action is needed to either bring ROI back in line, accept a new ROI, or even determine whether the project should proceed.

Summary

In this article, we

defined ROI in terms of returns and investment

showed how returns and investment usually have tangible and intangible components, and

gave examples showing why it is important to include both when defining the project, and when reporting status.

This will give all involved with the project a common understanding of expectations around project returns, resources that will be invested in the project, and any potential problem areas. And it will give purpose to the project reporting story.

Crevay can partner with you to improve reporting

If you think you could use some extra help with your reports, contact us. You don't need to be an expert to get the results you want. We help anyone with a project to find the right path forward.